June 30, 2025

Sports, Media and the Search for

Uncorrelated Returns

Introduction

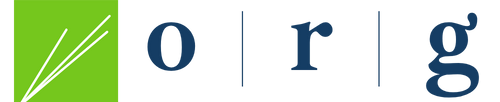

The global sports market ranks amongst the largest global industries with an estimated present value of $507.7 billion forecasted to increase by 70% to $862.6 billion in 2033 [1]. Despite its size, the sports asset class is often overlooked by institutional investors as it has traditionally attracted interest from ultrawealthy individuals seeking ownership for the purposes of vanity and pride. However, it has been well proven that sports are a viable asset class for investment due to its uncorrelated performance compared to a traditional investment portfolio, steady appreciation and predictable business cashflows, continued contribution to portfolio diversification and scarcity with a limited supply of deeply entrenched teams in established leagues. In fact, the Major League Soccer (“MLS”), National Basketball Association (“NBA”), Major League Baseball (“MLB”), National Hockey League (“NHL”), National Football League (“NFL”) and the top global football clubs have all outpaced the S&P 500 over the past 20 years.

Source: Forbes, Yahoo Finance. “Global Football” represents data for the top 20 European football clubs as published by Forbes.

Drivers of Sport Businesses

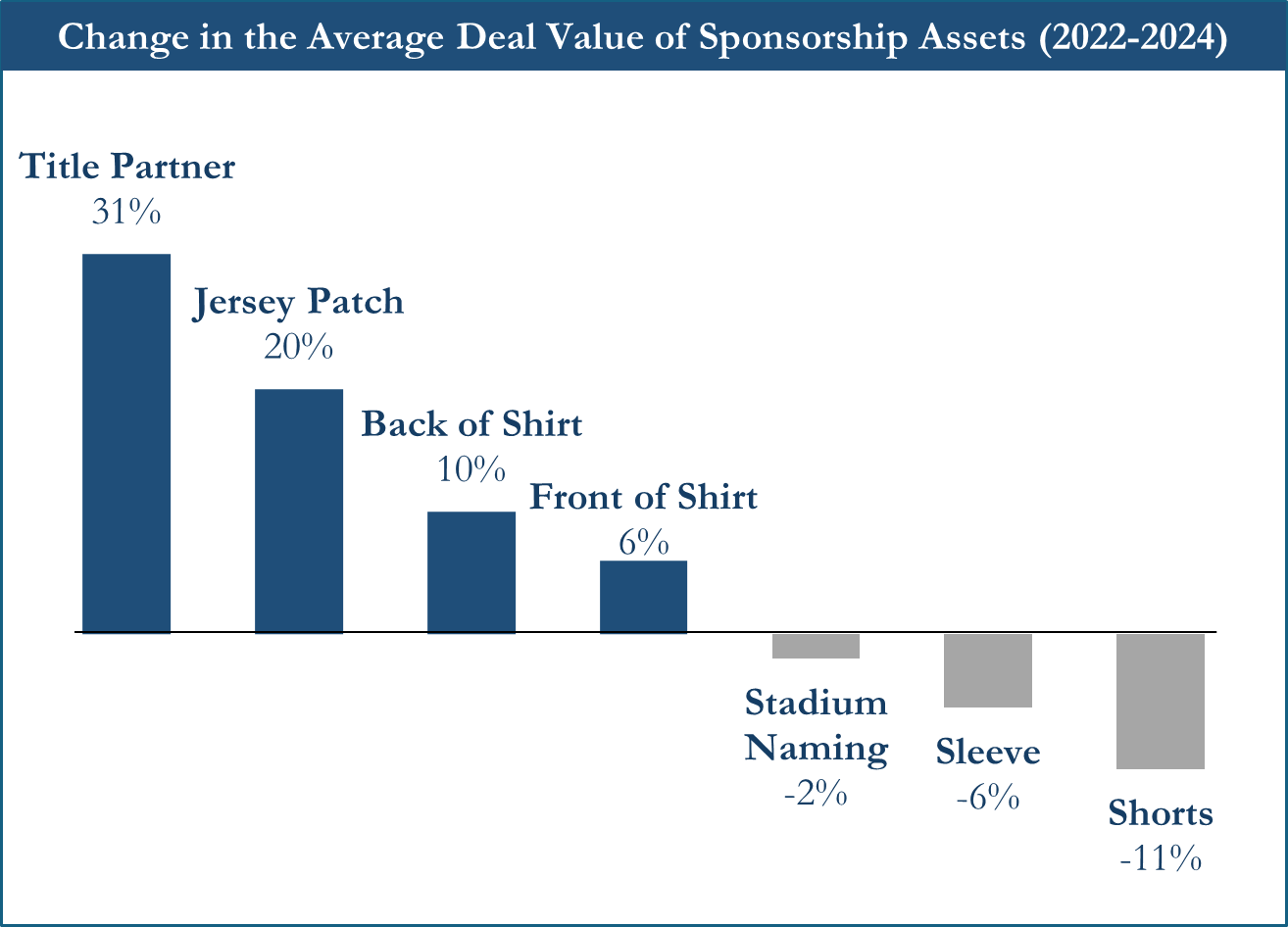

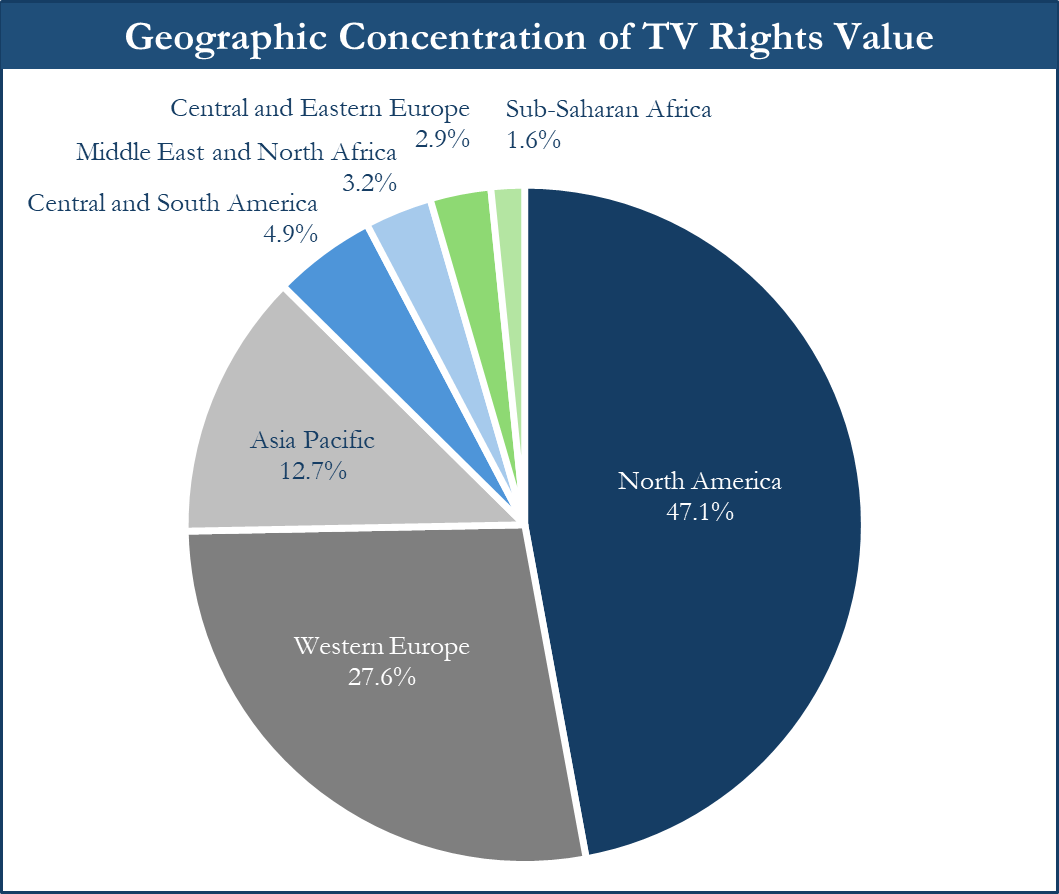

In the most simplified terms, sports teams are predominantly media businesses where the majority of the revenue is driven by broadcasting, commercial and gameday inflows. Furthermore, the revenue stream of the sports market is concentrated in media and broadcasting rights as they accounted for more than 50% of the total revenue of the major US leagues and global football in 2023 [2].

Gameday revenue is comprised of the total revenue generated during a home game, which is driven by season passes and ticket sales, hospitality packages, food and beverage concessions and sales of goods at the stadium. Teams with more stadium capacity, strong fan support and consistently full gameday attendance are capable of generating significantly more gameday revenue than smaller competitors.

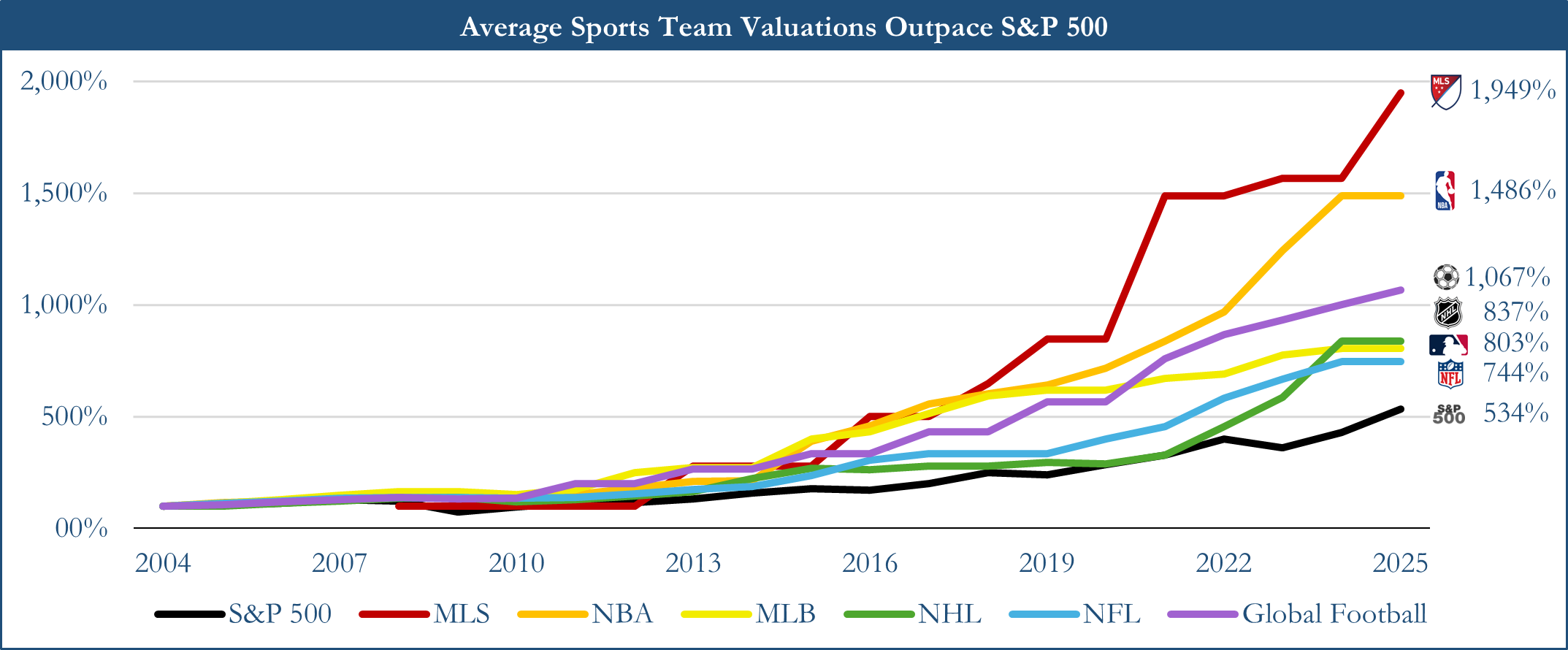

Merchandise and apparel sales, sponsorship, venue monetization and naming rights are all avenues for commercial revenue generation. With greater brand awareness, sports teams are able to unlock opportunities that capitalize on name recognition and maximize revenue sources. From 2022 to 2024, the average sponsorship deal value of title partnerships experienced the strongest growth [3]. Title partnerships are a form of sponsorship whereby a brand or company acquires the right to be the primary sponsor of a sporting event, league, team or broadcast in exchange for extensive visibility through logo placement, media coverage, advertising slots and inclusion of its name in the title of the event such as the “Formula 1 Louis Vuitton Australian Grand Prix 2025”. The global sponsorship market has grown significantly year-over-year with the market size estimated at $114.5 billion in 2025 and an expectation of continued compounded annual growth of 7.8% through 2030 [4].

Source: Ampere Sports - Sponsorship

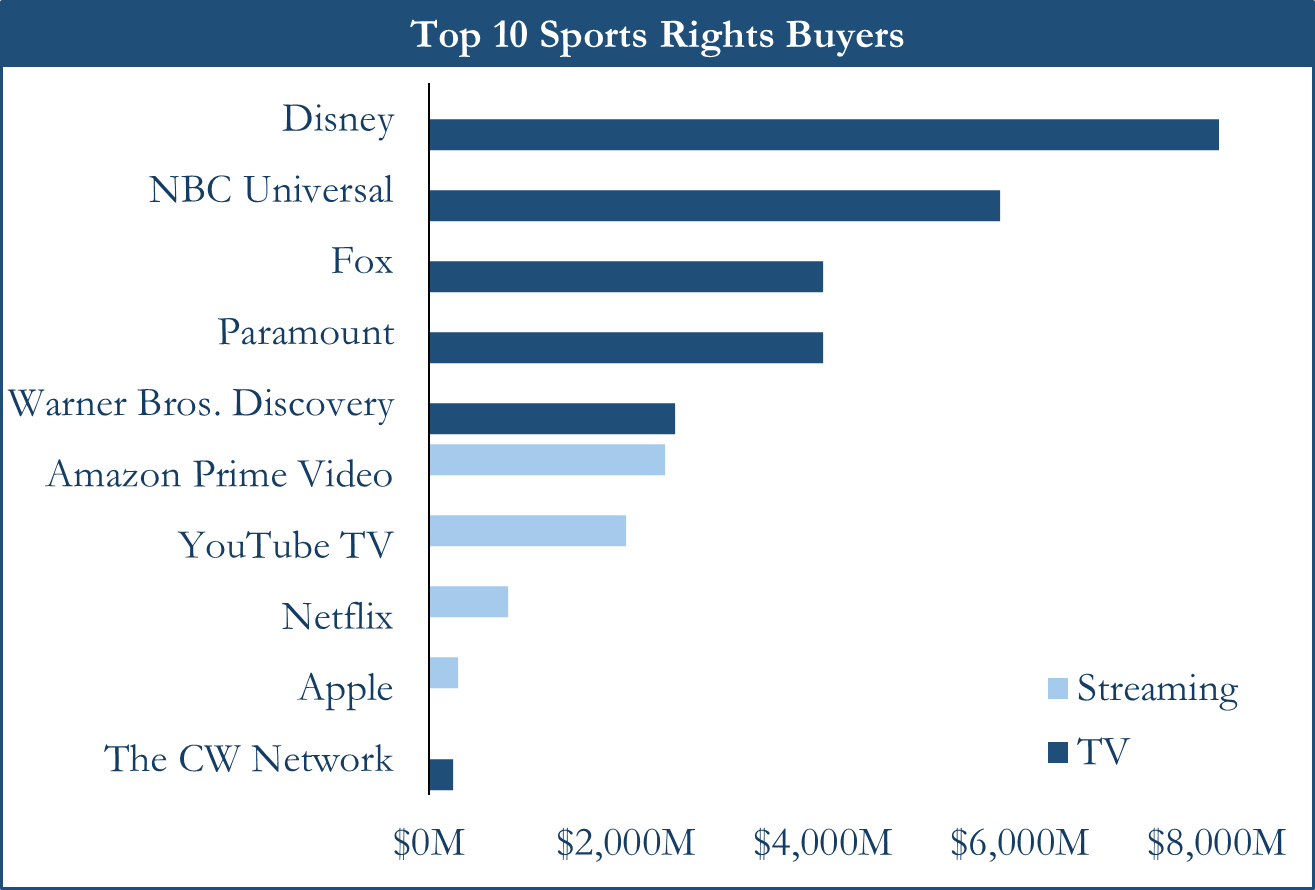

Finally and most importantly, sports teams heavily rely on the revenue generated by broadcasting and media rights. In leagues where teams with poor performance are at risk of relegation, broadcasting revenue can prove to be volatile as the revenue awarded to each team is dependent on league and team standing amongst the other competition. With increasing popularity of streaming and streaming technologies, live entertainment and production of league and team focused documentaries, the value of global sports media contracts has grown from $24.5 billion in 2011 to more than $62.4 billion in 2024 [5].

Source: Jefferies & Company; 2024. “IPL” stands for Indian Premier League.

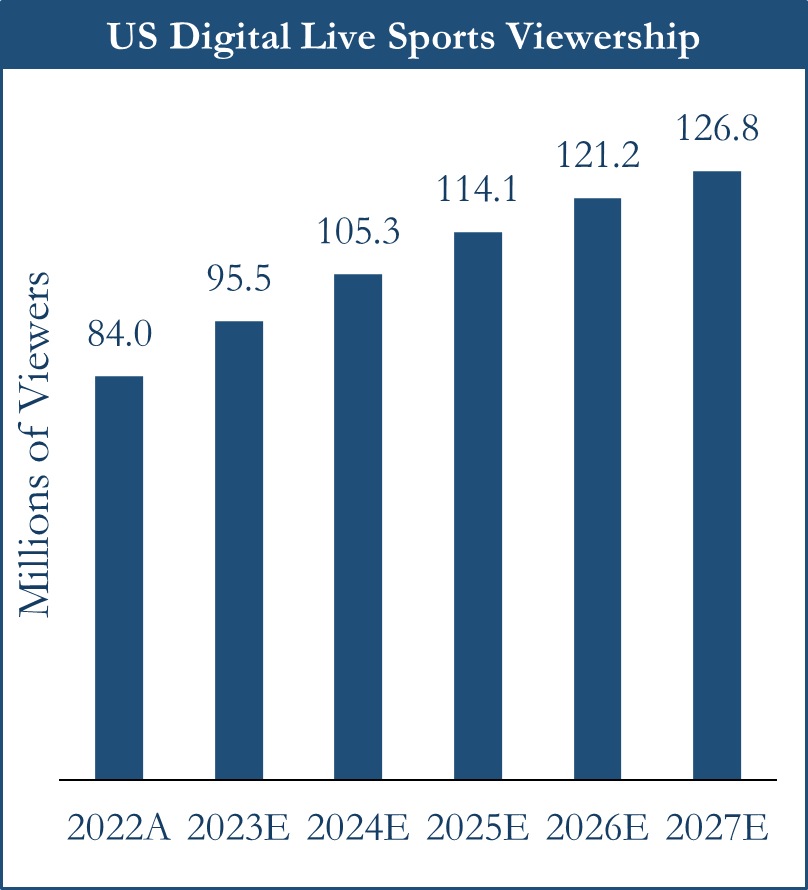

Source: Ampere Sports – Media Rights 2023

Within media, live sports entertainment has been a prominent segment driving additional revenue as it is the most effective content to keep viewers subscribed. On demand streaming platforms such as Netflix and Amazon Prime Video have shifted consumer behavior from tuning in at specific times for television content to today where consumers have become accustomed to the privilege of watching nearly all content on demand, and sports events are some of the few remaining broadcasted content that consumers still desire to watch live. Because of this, competition amongst streaming platforms has grown for exclusive broadcasting rights and viewership as seen in Netflix and Amazon Prime Video’s involvement in the $100 billion broadcasting deal with the NFL [6] as well as Amazon Prime Video’s involvement in the $76 billion deal with the NBA [7]. Moreover, digital live sports viewership is projected to continue to grow significantly resulting in persistent media revenue growth and an uplift in team valuations.

Source: Ampere – Sports Media Rights; 2025

Source: Forbes and Wall Street Research

Institutional Ownership in Sports

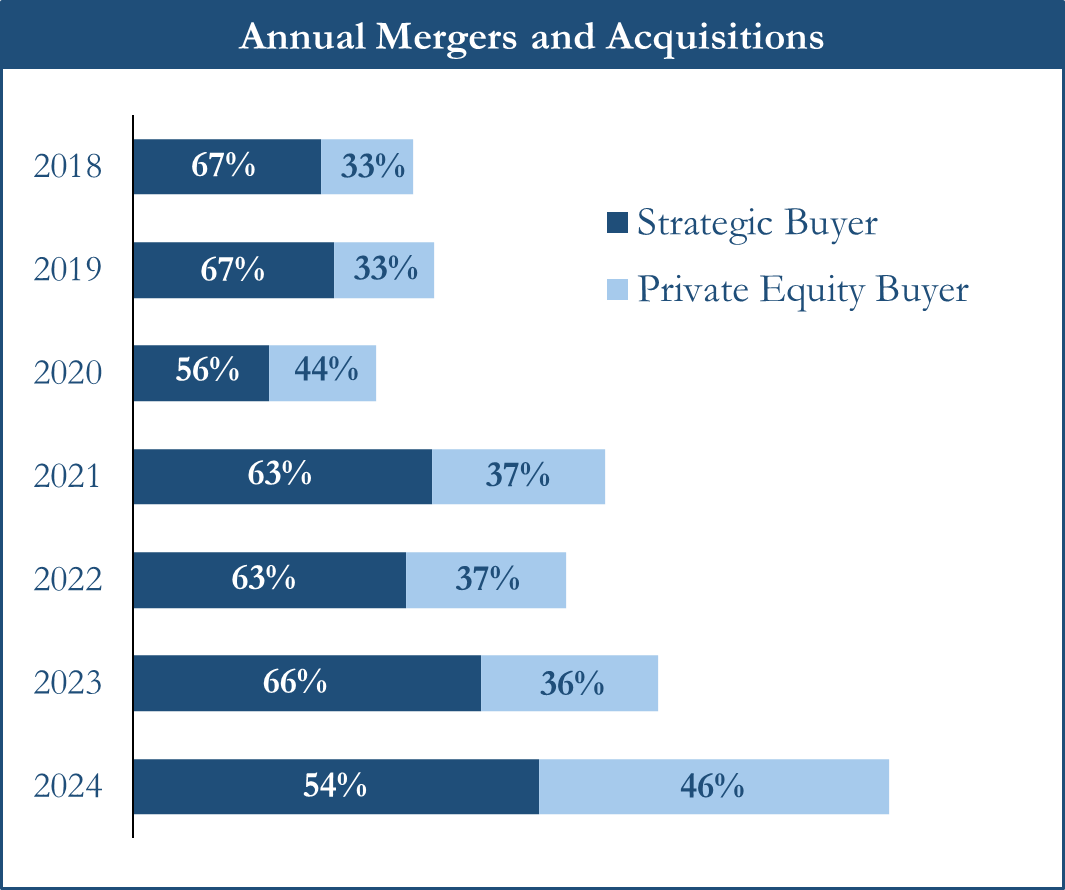

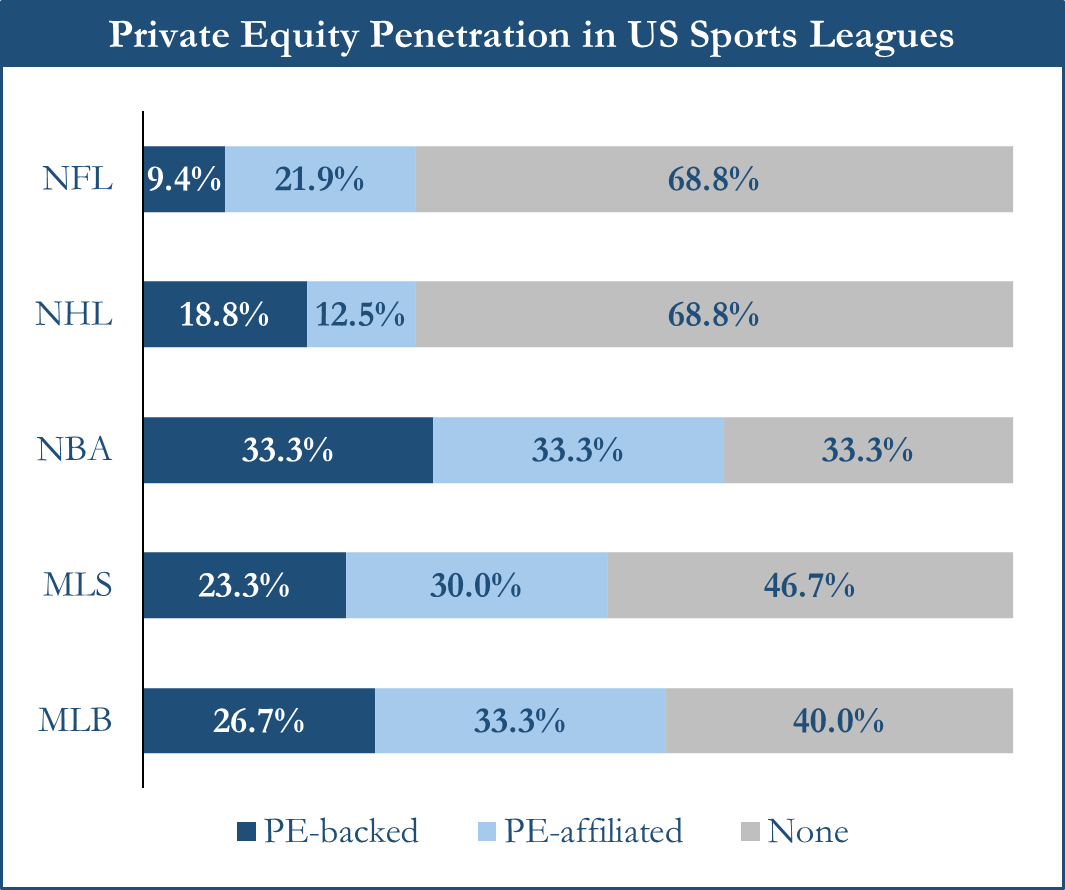

Ownership of sports teams has historically been limited to only the ultrawealthy, however, institutional capital has recently entered the market as an acquirer of majority and minority interests in several of the largest sports leagues globally. With the earliest acquisition of a majority ownership interest in a team by a private equity firm occurring in 2006 [8], there has been a growing demand for institutional ownership interests in sports teams while values and acquisition pricing have simultaneously and substantially risen. Increasing team valuations, with the latest transaction headline eclipsing $10 billion [9], have created an opportunity likely to be more suitable for the vast pool of institutional capital available today. Accordingly, approximately 46% of 410 sports related transactions were completed by private equity groups in 2024 as opposed to 34% in the prior year [10].

Source: Oaklins; 2024

Source: PitchBook; May 2024

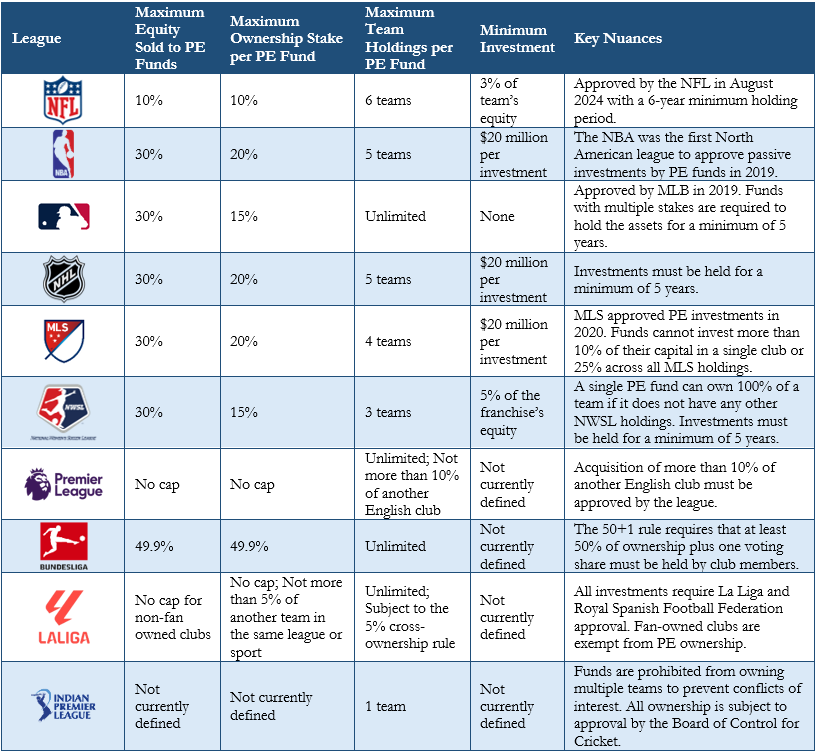

Until recently, acquisitions of interests in teams across the globe by institutional investors were entirely prohibited or maximally restricted in many instances. While some restrictions remain in place, institutional capital has begun to participate within the guidelines outlined below. It should be noted that every league independently regulates its limitations on institutional ownership.

Source: Sports Business Journal, Sportico, ESPN, Norton Rose Fulbright, and NFL.com. “PE” stands for private equity.

Although acquisitions by institutional groups remain restricted, ORG believes that institutional capital can provide sports investments with a disciplined path to growth while limiting any emotional aspect from team ownership and management. Institutional investors are predominantly return driven with the expectation that investments will be held over a 5 to 10-year period, which complements the investment processes of acquiring a team, completing the business plan and achieving success upon exit.

Private Equity Approach to Investing in Sports

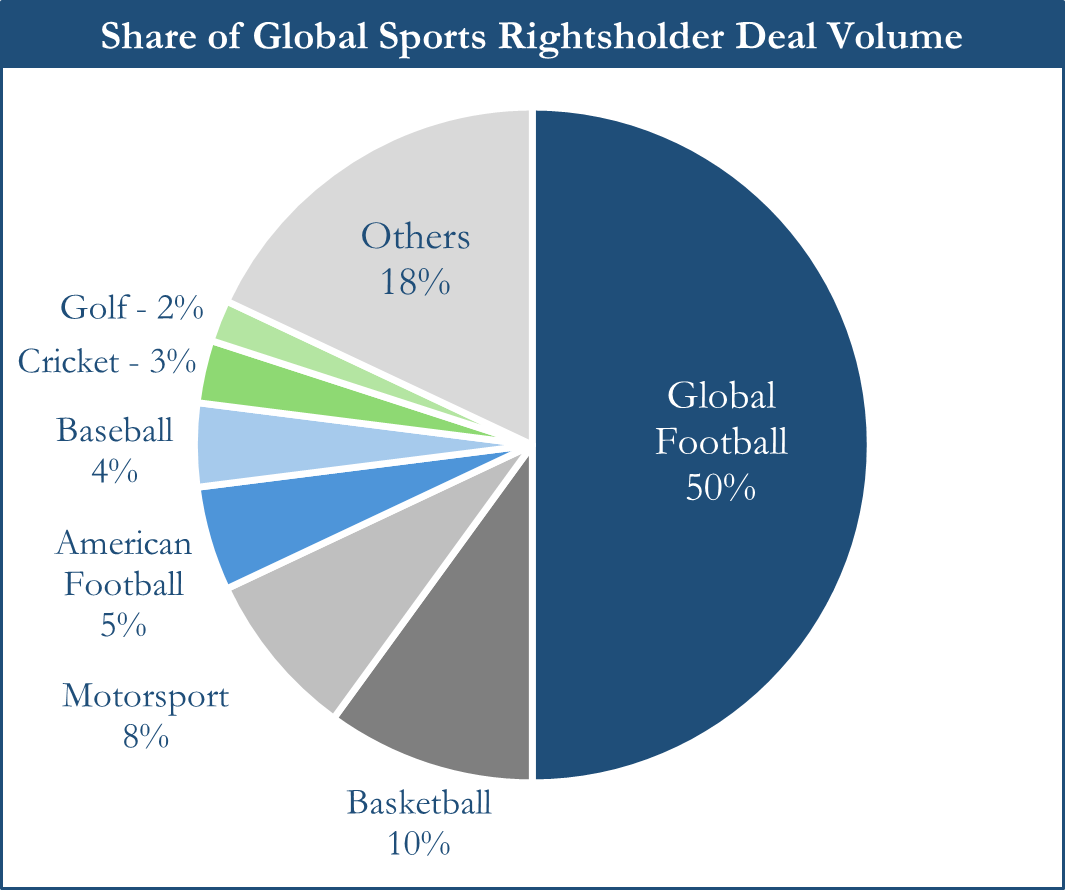

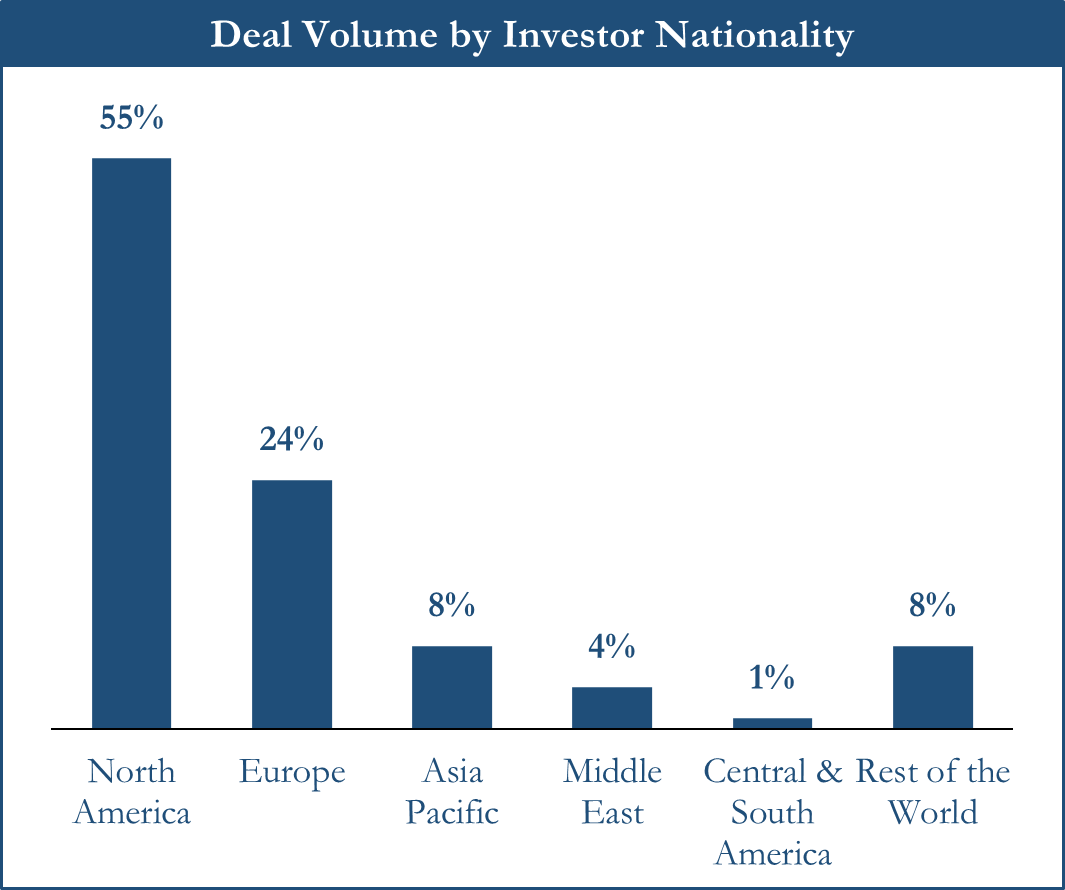

Sports investment is often considered attractive due to financial justifications such as its uncorrelated performance and decreased volatility, continued contribution to portfolio diversification and scarcity with a limited supply of teams deeply entrenched in established leagues. Within the last year, global football (known as soccer to most Americans) attracted the most significant capital investment as global football club transactions accounted for 50% of all deal volume with North Americans representing 55% of all sports acquisitions in 2024. Additionally, 48% of the capital deployed was in minority positions [11] likely due to the loosening investment restrictions by leagues as well as smaller capital commitments required.

Source: Deloitte; 2024

ORG encourages evaluating and pursuing sports investments with a private equity mindset: acquiring undervalued teams with growth potential where value can be added through engaging new management, stadium improvements, revenue optimization and exiting at an improved valuation. In order to successfully execute the private equity approach, investors must remain disciplined in buying teams at a discount and selling when the full value has been achieved to maximize investor returns. Additionally, ORG highlights the importance of alignment of interests across all levels of sports investments.

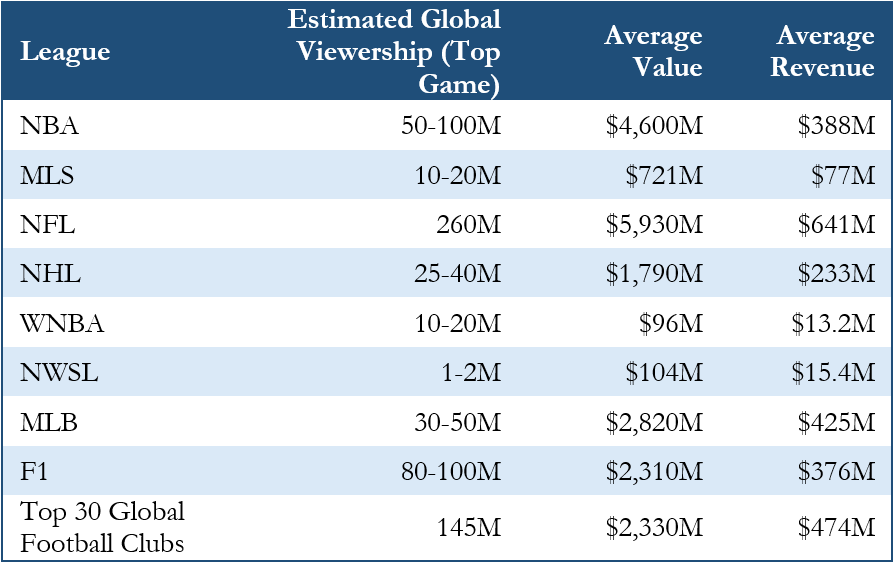

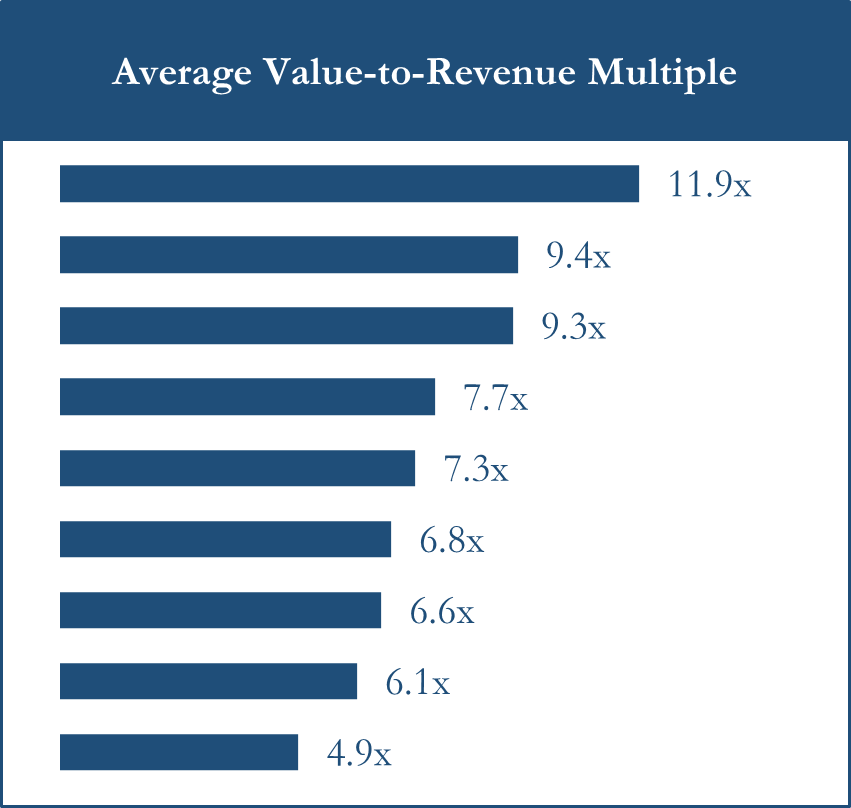

Valuations of sports teams are typically calculated as a multiple of revenue where average transaction multiples vary between sports and leagues. Similar to other non-sports investments, positive performance can be derived from harvesting beta and generating alpha. By acquiring teams in undervalued leagues with potential for multiple expansion, investors are able to harvest organic appreciation propelled by rising popularity in media and viewership.

Source: Sportico. Top 30 Global Football Clubs does not include any MLS teams. “WNBA” stands for Women’s National Basketball Association, “NWSL” stands for National Women’s Soccer League and “F1” stands for Formula 1.

Alternatively, alpha generation is underpinned by sourcing discounted, underinvested and underappreciated teams with an opportunity to create value through management and facility improvement to attract stronger talent, reinforcing and developing the team’s player acquisition market and expanding the fanbase and revenue streams. One of the largest line items on a team’s profit and loss statement is player and staff wages, however the quality of on-site management and players propel the performance of a sports team in terms of placement within the league. ORG emphasizes the value of success on the field while maintaining a focus on minimizing expenses such that teams develop a balance between performance and not overspending. Another area to generate alpha is through the implementation of technology across various areas of the business to improve player health and training, performance tracking, data analytics, game strategy, scouting and recruitment, stadium operations, fan engagement and experience and marketing campaign reach.

Many sports assets have been untouched or vanity assets that have not been run efficiently for several years causing them to fall behind and trade at a discount to other league incumbents which creates an opportunity for acquisition by private equity groups who have the ability to modernize and exit at a premium. Ultimately, ORG believes that harvesting beta has limited hurdles beyond acquisition, while alpha generation is nuanced and requires experienced and aligned personnel across all levels of investment.

Risks and Opportunities

Although sports have proved to be a historically attractive asset class, ORG acknowledges that investing in sports is not without risk. Numerous headlines have been published on new or niche sports with limited barriers to entry demonstrating an increased appetite for seemingly “high growth” sports, however niche sports have not been tested and proven to withstand and be supported by media contracts and viewership. Despite potential revenue stream and sponsorship discovery in newly created leagues, ORG believes that investing in entry level sports with limited stability and track record involves significantly more risk than entrenched sports and leagues that have displayed an increasing momentum for revenue growth and value creation.

Although minority interests in sports teams have risen in popularity and created broader access for individuals, investors must acknowledge that there are additional risks prevalent in non-controlling positions as these interests are subject to the decision-making of the control owner and traditionally sell at a discount to the controlling counterpart. Minority investors often lack influence over the team’s operations, financing and liquidity while majority interests may have the ability to restrict selling or even dilute non-controlling members. Because of minority investors’ dependence upon the controlling entity to create value and generate attractive returns, ORG believes that rigorous underwriting of the controlling group must occur before committing capital to any minority position.

Investors must also be heedful to the reliance on terminal value rather than consistent dividend distribution for return generation as sports investments often behave similarly to private equity investments that provide growth capital to a company with the expectation of recouping and multiplying invested capital upon exit. Additionally, entry pricing and operational management are of the utmost importance as merely expending vast sums on a team does not ensure prudent investment and teams frequently operate on a negative cashflow basis due to overspending on players and operations. Owners must exhibit financial sensitivity and wherewithal with long-term conviction in the acquired asset.

Conversely, ORG believes that opportunity exists in acquiring teams from vanity owners that have demonstrated an inability to effectively manage the assets and are forced to sell at a discount to the competitive peer set. Buyers in search of ownership for the sake of personal or emotional reasons may also be an effective market for liquidation at a premium after the business plan has been executed.

As live entertainment has been a major catalyst for revenue generation in sports, ORG asserts that broadcasting, media and sponsorship contracts will exhibit continuous expansion due to proliferating competition amongst streaming platforms, media companies and advertising budgets. In order to capitalize on viewership momentum, leagues have begun to explore expansion efforts such as hosting games in other countries where teams can tap into additional viewership and fan support abroad. One such example is that the NFL began hosting its International Series in 2007 where the New York Giants and the Miami Dolphins played at Wembley Stadium in London. The International Series has now expanded so that at least four games are played internationally each season [12]. ORG believes that finding ways to grow current fanbases and expand into new audiences can create a platform for substantial revenue growth and subsequently notable value creation.

Conclusion

Capital deployment in sports investments by institutional investors has proliferated in the years since the first majority stake acquisition in 2006 as ownership of sports teams is often better suited for institutions that have access to a substantial pool of capital that is focused on measured growth and long-term stability. Today, private equity allocators have accounted for an increasing share of total sports deal volume and positive performance of sports assets is predominantly driven by revenue expansion, streamlined operations at the asset level and widespread appreciation. As broadcasting and media rights transactions continue to command substantial capital inflow from competing television and streaming platforms, ORG believes that teams deeply entrenched in proven leagues with a history of irreplicable tradition and culture and a clear path to value creation present the highest conviction opportunity to achieve attractive returns for investors.

[1] Business Research Company, The. “Global Sports Market Report 2025, Opportunities, Forecast to 2034.” The Business Research Company, Mar. 2025.

[2] Badenhausen, Kurt. “How Sports Teams, Leagues and Owners Make Money.” Sportico.Com, Sportico.com, 2 Jan. 2025, www.sportico.com/feature/how-sports-teams-leagues-make-money-1234766931/.

[3] Modha, Minal, et al. Ampere, 2025, A Year of Sport 2024 - Full Steam Ahead in 2025.

[4] 360iResearch, 2025, Sports Sponsorship Market by Type (Club & Venue Activation, Digital Activation, Signage), Category (Apparel Sponsorship, Event Sponsorship, Media Sponsorship), Activation Timing, Application, Sport Type - Global Forecast to 2025-2030.

[5] Gupta, Suraj. “Are Professional Sports Teams Overvalued?” Forbes, Forbes Magazine, 13 Aug. 2024, www.forbes.com/councils/forbesbusinesscouncil/2024/04/12/are-professional-sports-teams-overvalued/.

[6] “N.F.L. Signs Media Deals Worth over $100 Billion - The New York Times.” The New York Times, 3 Mar. 2021, www.nytimes.com/2021/03/18/sports/football/nfl-tv-contracts.html.

[7] Press, Associated. “Reports: NBA Agrees to Terms on $76B Media Rights Deals.” ESPN, ESPN Internet Ventures, 10 July 2024, www.espn.com/nba/story/_/id/40535771/reports-nba-agrees-terms-76-billion-media-rights-deal.

[8] Coffey, Brendan. “Sports Grow from Private Equity Afterthought to Booming Market.” Sportico.Com, Sportico.com, 16 May 2024, www.sportico.com/business/finance/2024/when-did-private-equity-start-investing-in-sports-teams-1234779117/.

[9] Badenhausen, Kurt. “Lakers to Be Sold to Dodgers Owner Walter at Record $10B Valuation.” Sportico.Com, Sportico.com, 19 June 2025, www.sportico.com/business/team-sales/2025/los-angeles-lakers-sale-buss-family-mark-walter-1234857182/.

[10] Dixon, Ed. “Exclusive: Sports Mergers and Acquisitions Rise 44% in 2024 as Private Equity Fuels Record Year.” SportsPro, 6 Mar. 2025, www.sportspro.com/news/sport-mergers-acquisitions-2024-leagues-teams-nfl-march-2025/.

[11] “Deloitte’s 2025 Sports Investment Outlook.” Deloitte United Kingdom, 5 Mar. 2025.

[12] “The NFL International Series.” NFL Football Operations, operations.nfl.com/journey-to-the-nfl/the-nfl-s-international-impact/the-nfl-international-series/.