August 1, 2024

Mortgage Loan Repurchase Agreements

What Investors Should Know

Introduction

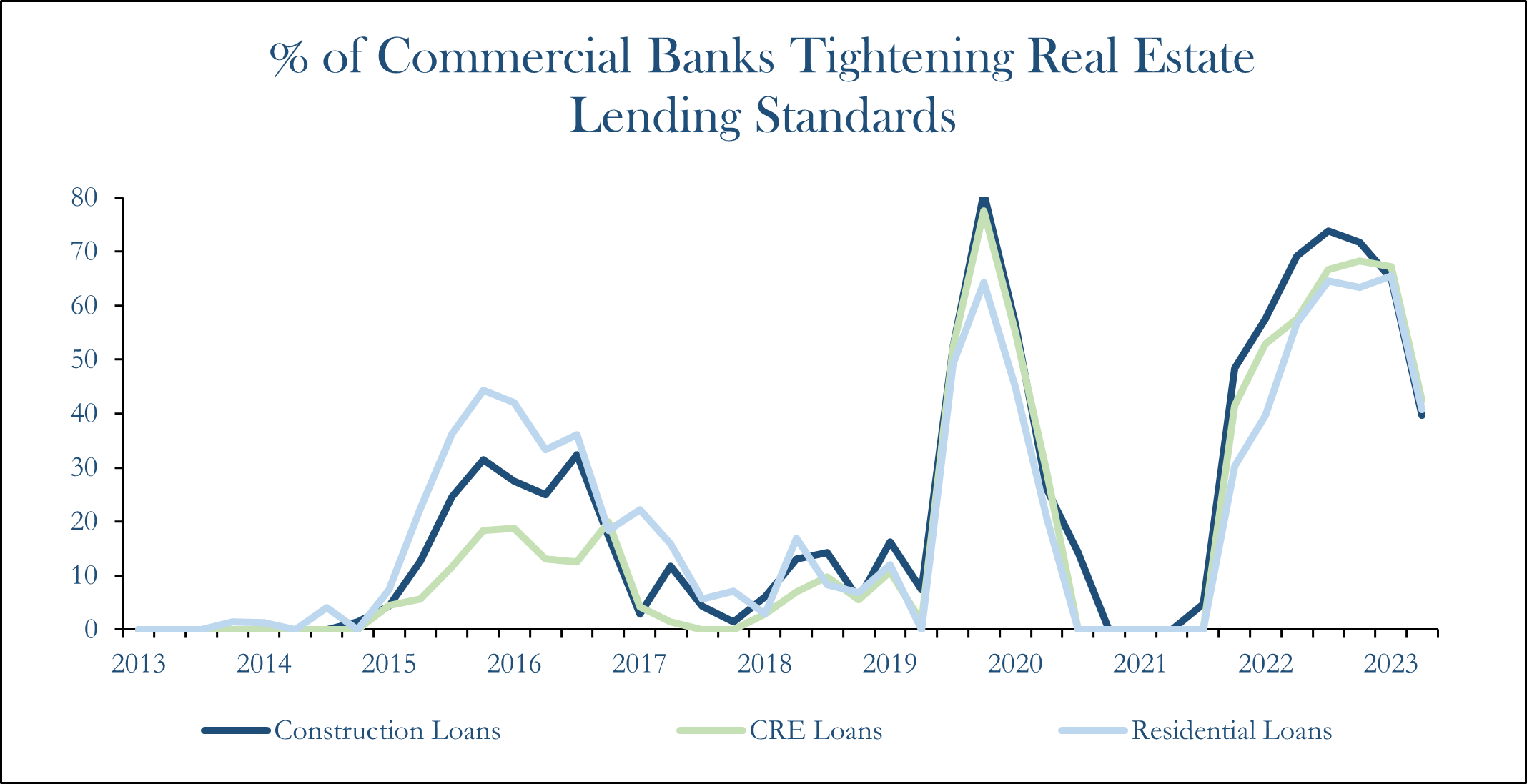

Since the United States Federal Reserve began increasing interest rates in March 2022, the Federal Funds rate increased from a range of 0.00%-0.25% to 5.25%-5.50% today. High base rates have caused significant duration risk for many existing real estate loan portfolios owned by regional banks and have been a catalyst for multiple recent commercial bank failures. Many commercial banks have significantly tightened their lending standards for new real estate loans since early 2022 as they look to de-risk their portfolios and avoid regulatory scrutiny. As a result, real estate borrowers who traditionally have relied on commercial banks for approximately 38% of all commercial real estate loans [1], have needed to look for additional sources of capital to finance real estate investments. In the absence of commercial bank financing, real estate debt funds have experienced a resurgence since they are able to lend at higher interest rates than in prior years.

United States Commercial Banks have significantly tightened their lending standards for new commercial real estate loans since 2022. Source: Mortgage Bankers Association Senior Loan Officer Opinion Survey

Real estate debt funds may pursue many different strategies to enhance their returns. In most non-core whole loan debt strategies, the real estate investment manager will first identify a property with a sponsor in need of a whole loan, typically for acquisition or refinance. Then the investment manager will originate the loan and lever their position with financing from a bank or through alternative structuring. This leverage to enhance the returns of the loan can come in multiple forms including but not limited to mezzanine structuring, when the investment manager sells a senior piece of the loan to a financial institution, or note-on-note term matched financing, when the investment manager undertakes a single loan to directly lever a mortgage loan in their portfolio. Increasingly, real estate debt managers have turned to Mortgage Loan Repurchase Agreements (“repo facilities”) when pursuing levered whole loan strategies, which have different features and characteristics from the methods above.

-

Loan is purchased with the agreement that the fund manager will repurchase the assets at a future date

Capital Structure Position: Senior

-

Whole loan origination, followed by the creation of a junior and senior tranche

Capital Structure Position: Senior, Junior tranche retained post restructuring

-

Financing through the creation of an investable security that is typically publicly traded

Capital Structure Position: Senior

-

Fund pledges original note as collateral

Capital Structure Position: Senior

-

Financing is made through private investors

Capital Structure Position: Senior

In this article, ORG will explain what repo facilities are, how they work and the benefits of repo facilities for both financial institutions such as banks (“buyers”) and real estate debt investment managers (“sellers”).

What Are Repo Facilities?

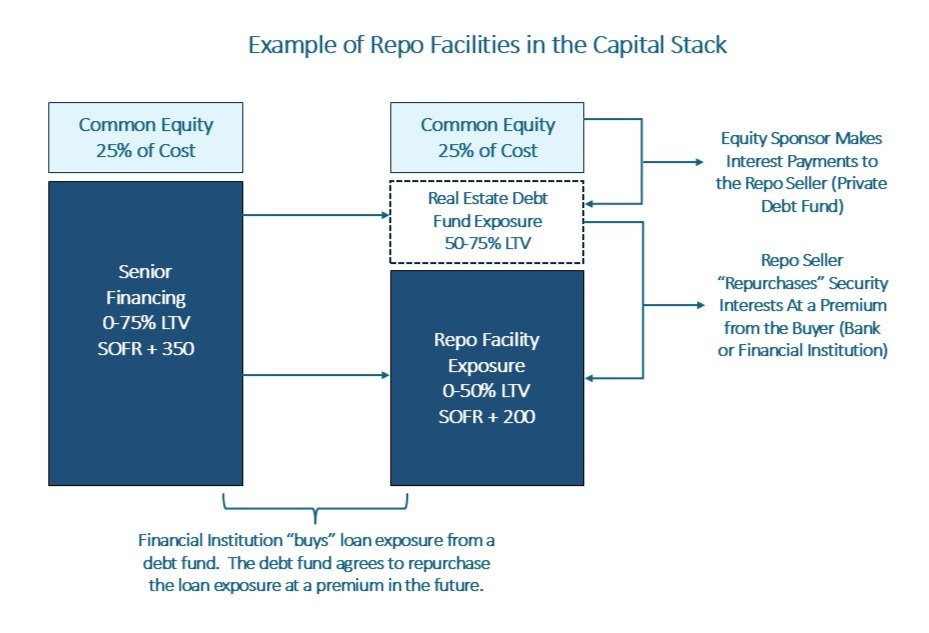

A repo facility is a financial instrument that can allow a party to sell a mortgage loan to a buyer, where the seller will agree to buy back the mortgage loan at a later date and for a higher price [2]. The structure is in many ways like a credit facility where the price premium that the seller pays acts similarly to interest paid on a loan. With a repo facility, a real estate debt investment manager can lever the whole loans made within an investment vehicle, decreasing the amount of capital needed for each investment and potentially increasing its returns.

The main terms of repo facilities, similar to any real estate loan, are the pricing, term and leverage limitations. Today, repo facilities are generally priced at the Secured Overnight Financing Rate (“SOFR”) plus a spread of 150 to 250 basis points, are limited to two to three-year term at origination and a maximum loan-to-value (“LTV”) ratio of around 80%. The repo facility can usually be employed to lever whole loans with last-dollar exposure of around 40% to 50% LTV.

A key feature of repo facilities is the ability for the buyer to make a margin call. Real estate repo facilities are typically subject to mark-to-market provisions where the buyer is able to value the underlying collateral on an ongoing basis to assess the credit quality of the repo facility. If the buyer determines that the seller’s underlying collateral is unfit to satisfy the terms outlined in the repo facility documentation, they will often have the right to margin call the seller, requiring them to transfer additional assets to the buyer. Additionally, the buyer has protection under the bankruptcy code so that in the event of a seller filing for bankruptcy protection, the buyer still has the right to immediately accelerate the agreement and enforce setoff rights to seize the collateral [3] [4].

Benefits and Risks of Repo Facilities for Buyers and Sellers

Both the buyer and seller can receive benefits from the establishment of a real estate repo facility. Despite this, repo facilities are not without risks that both parties should consider.

Buyers of repo facilities are able to originate debt-like securities with significant amounts of rights and protections while achieving returns above the risk-free rate. The buyer’s ability to mark-to-market and issue a margin call to the seller can allow the buyer to manage risk efficiently. Repo facilities also often have recourse components to them which provides more protection to the buyer. Additionally, for banks who are buyers of repo agreements, the position is categorized as a security on their balance sheet as opposed to a real estate loan because of its technical structure as an option contract as opposed to a loan. This can allow banks and other financial institutions to gain exposure to real estate assets with better capital treatment and lower amounts of regulatory scrutiny. In the absence of traditional real estate lending from commercial banks, buyers of repo facilities could be seen as a significant enabler for private lending activity in the market today.

Sellers of repo facilities stand to benefit because of the significant flexibility that they provide. Real estate debt fund managers who are able to secure a repo facility can cross-collateralize multiple loans with a single lending relationship and in a single transaction. Repo facilities also can provide sellers with the best pricing to execute a levered whole loan strategy and achieve outsized returns in a real estate debt fund. Additionally, real estate debt fund managers may be able to target higher quality assets for whole loan originations with the flexible access to leverage a repo facility can provide.

Repo facilities can present some risk to sellers, and in turn to investors in debt funds that use repo facilities, despite their flexibility. One main risk of repo facilities is the mark-to-market adjustments that buyers have the right to make on the underlying loans in the facilities. Repo facility mark-to-market adjustments and margin calls can often seem arbitrary as buyers may look to quickly squeeze liquidity from repo facility sellers in the event that the buyer needs to quickly improve their balance sheet. To satisfy margin calls, repo facility sellers would have to either use capital reserves or sell their underlying loans, potentially at a loss, to generate liquidity. Repo facilities can also present risk as cross-collateralization and lack of matched term financing could present potential stress across a commingled portfolio of loans if mark-to-market adjustments occur. Additionally, it is important to understand that recourse is a common feature within a repo facility that can present risks to investors. A recourse agreement within a repo facility would mean that the seller is responsible for a portion or all of the remaining debt amount after liquidating its assets following a margin call. Therefore, if asset values have decreased substantially and sellers aren't able to fund their obligations to buyers sufficiently through the sale of assets, sellers will be liable for additional capital to pay off obligations to the buyer. This leaves investors liable for the capital they have invested as well as additional capital to cover the recourse arrangement which would completely unwind their potential to generate returns.

Conclusion

Repo facilities are a flexible option for real estate debt fund managers to execute levered loan strategies with efficiency and speed. They act as an options contract between an investment manager and a financial institution and allow the financial institution to gain exposure to real estate with significant contractual protections. Financial institutions and banks who are buyers of repo facilities also stand to benefit since the position is categorized as a security rather than a real estate loan on their balance sheet. Debt fund managers who utilize repo agreements to lever their positions can potentially outperform through efficiency and flexibility of execution and lower all-in costs. Despite this, the debt fund managers do incur risk through the terms of the repo agreement such as cross-collateralization, lack of term matching, potential for margin calls and recourse arrangements. ORG believes that it is important for investors to understand and differentiate the types of levered whole loan debt fund strategies offered by the market in today’s ever-changing economic environment.

[1] Rich Hill, March 2023, “The commercial real estate debt market: Separating fact from fiction,” Cohen & Steers, https://assets-prod.Cohenandsteers.com/wp-content/uploads/2023/03/29155844/The-commercial-real-estate-debt-market-Separating-fact-from-fiction-VP709.pdf.

[2] Nathan Reiff et. al., April 7, 2024, “Repurchase Agreement (Repo): Definition, Examples, and Risks,” Investopedia, https://www.investopedia.com/terms/r/repurchaseagreement.asp.

[3] Gennady A. Gorel et. al., May 2023, “Mortgage Loan Repurchase Facilities: A Brief Overview of a Frequently Used Financing Structure,” Dechert Global Finance Group

[4] June 5, 2024, “Right of setoff definition,” AccountingTools, https://www.accountingtools.com/articles/right-of-setoff