2025 United States Real Estate Outlook

In 2025, ORG anticipates an investment environment with capital markets that will become more open due to the real estate industry adjusting to elevated interest rates.

February 3, 2025

Introduction

Looking back at 2024, many investors eagerly awaited the prospects of future rate cuts but remained cautious due to uncertainty around potential labor market weakness, softening rent growth for real estate assets located in growth markets, real estate investment managers taking on negative leverage and uncertainty around global politics and elections. In hindsight, little transaction or capital activity occurred as many investors awaited a global easing of interest rates.

In 2025, ORG is anticipating an investment environment with capital markets that will become more open due to the real estate industry adjusting to interest rates that are higher than the pre-pandemic era. In this article, ORG will review the major market developments of 2024 and what investors should watch for in 2025.

Capital Markets

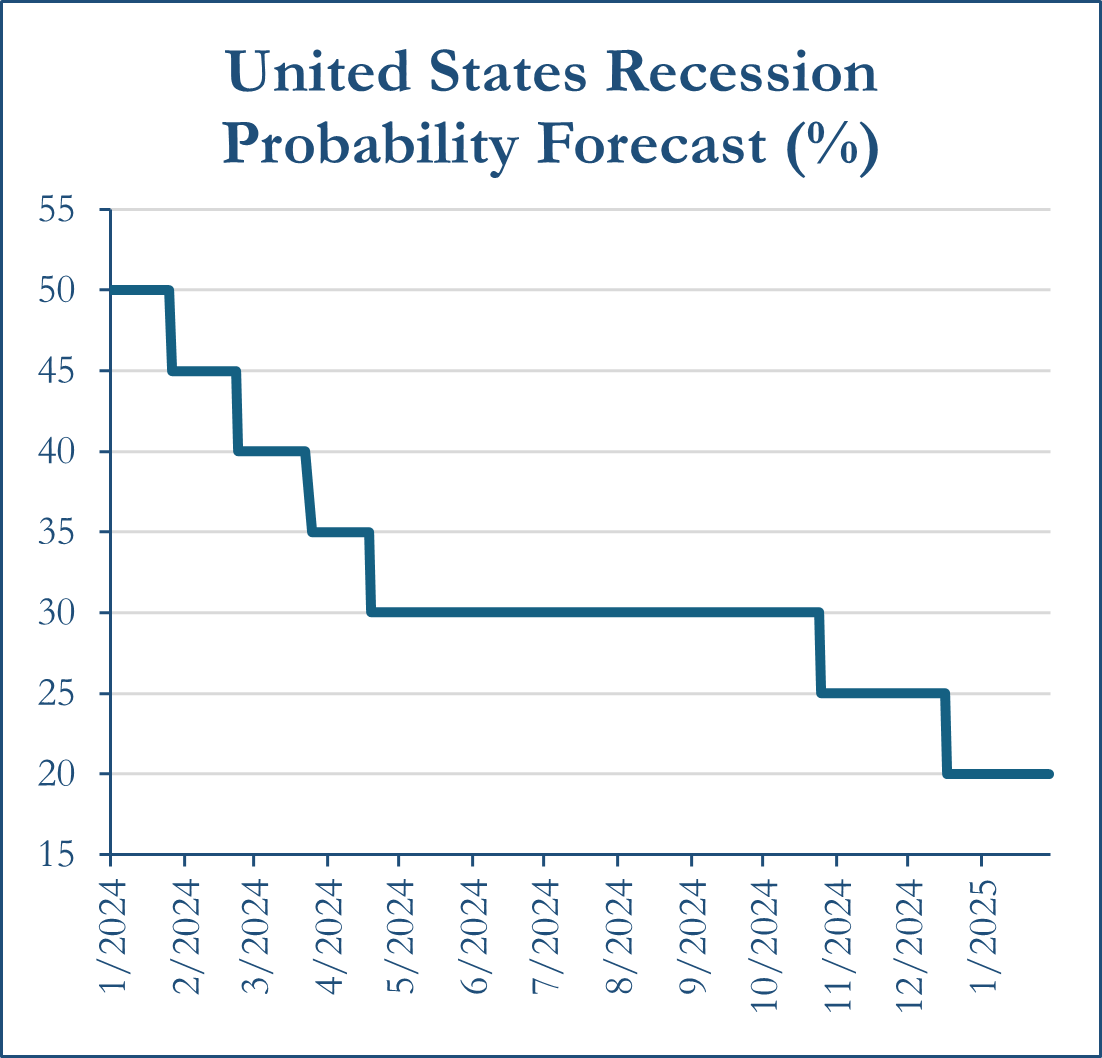

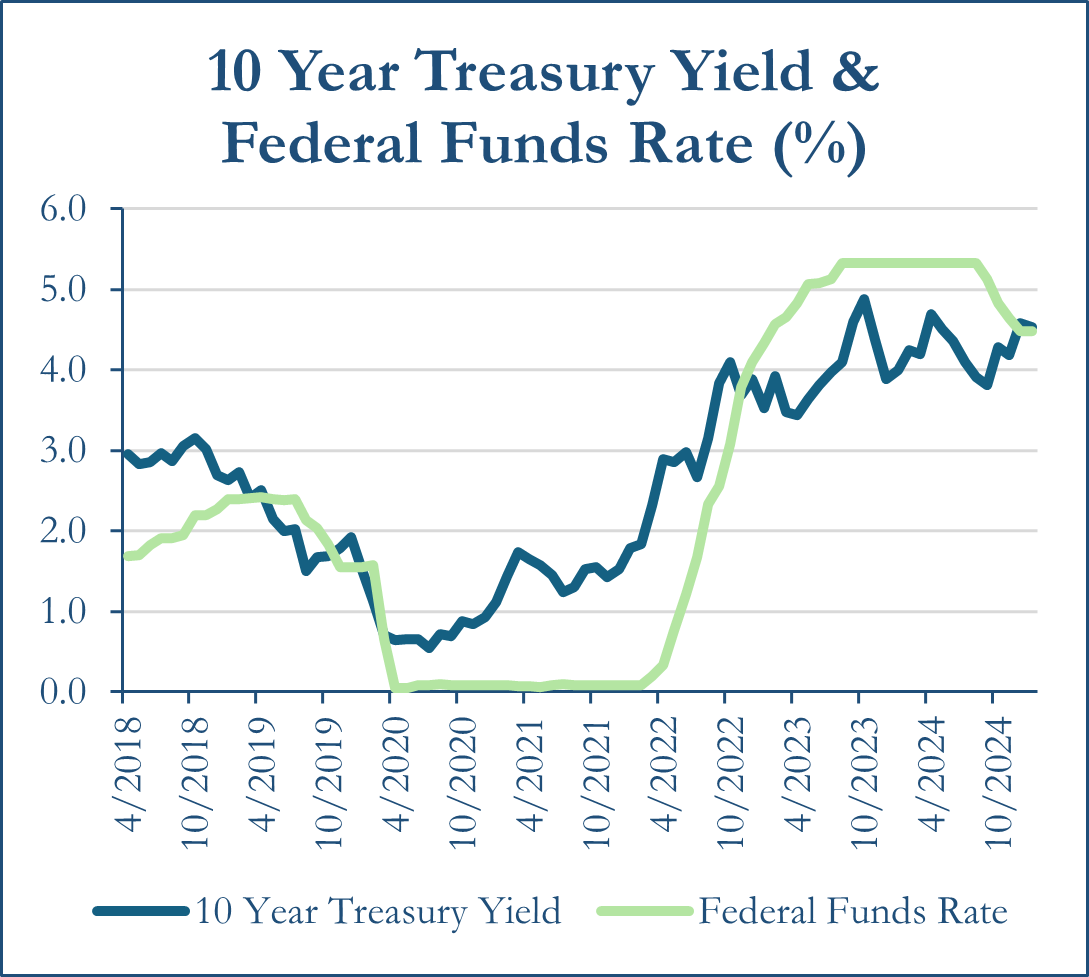

The Federal Funds rate currently sits at a target range of 4.25% to 4.50% with the 10-Year United States Treasury yielding between 4.51% and 4.80% throughout January 2025. The normalized yield curve was a result of decreasing inflation and easing employment market conditions. The current yield curve indicates a significantly decreased risk of recession compared to prior yield curves throughout 2024.

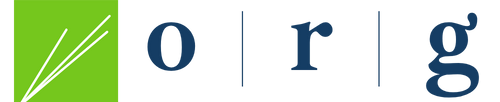

The probability of recession in the United States has fallen throughout 2024. Source: Bloomberg

The United States Treasury Yield Curve has normalized. Source: Bloomberg

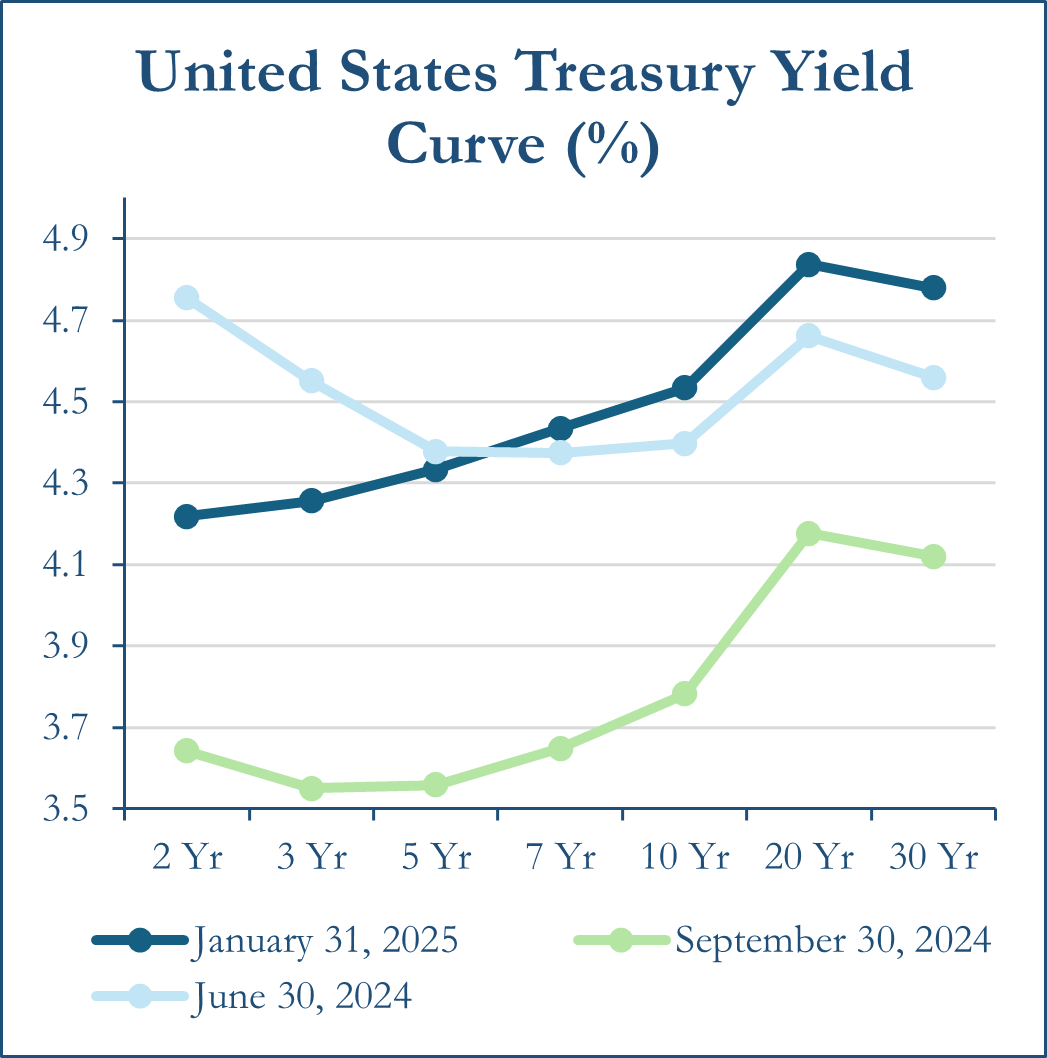

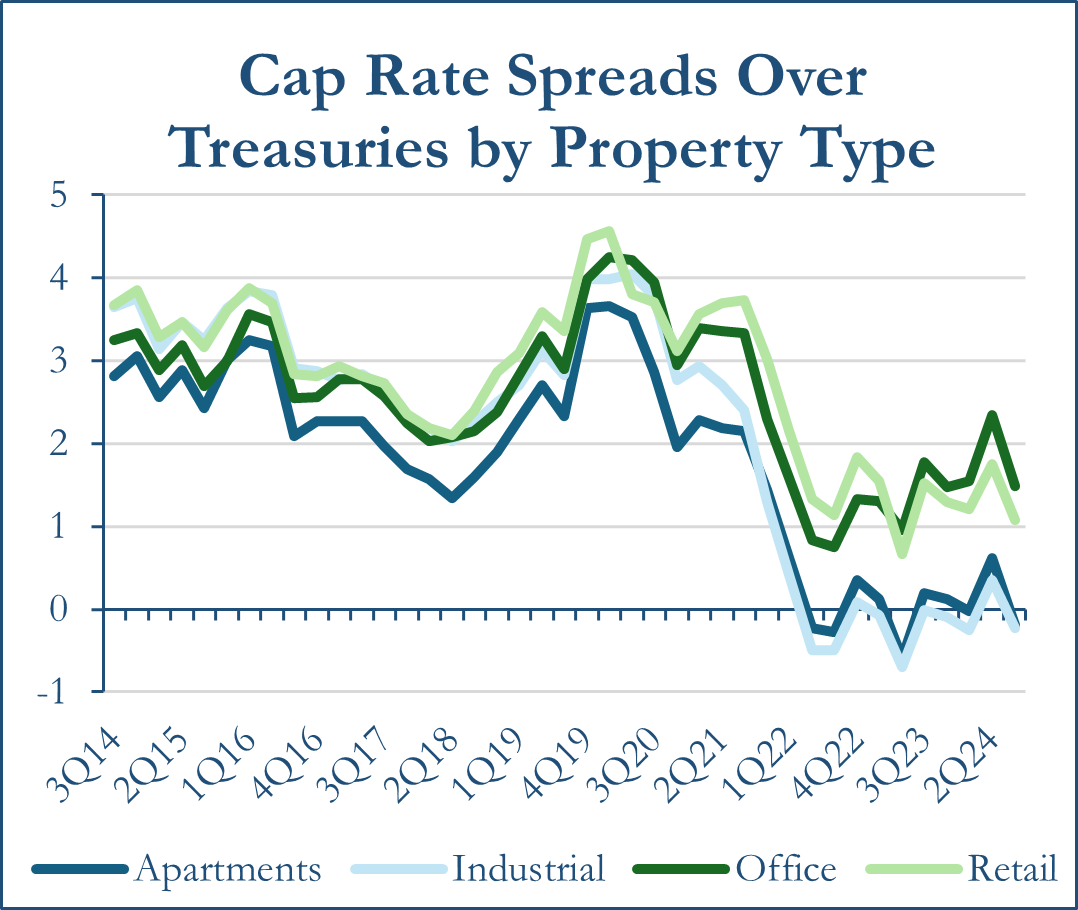

While interest rates remain higher than pre-pandemic levels, ORG has perceived that many real estate market players have adapted to the elevated rate environment by procuring financing from relationship lenders, agencies, life insurance companies or the CMBS market as opposed to the traditional banking system. As a result, transaction volumes have begun to increase slightly as equity business plans begin to become more viable. Part of this adaptation has been a result of expanding cap rates. ORG believes that cap rates for many property types have likely reached their peaks for this cycle.

Cap Rates have expanded since early 2022. Source: NCREIF Property Index

The Federal Reserve has decreased interest rates since September 2024. The 10 Year has risen slightly despite this. Source: FRED

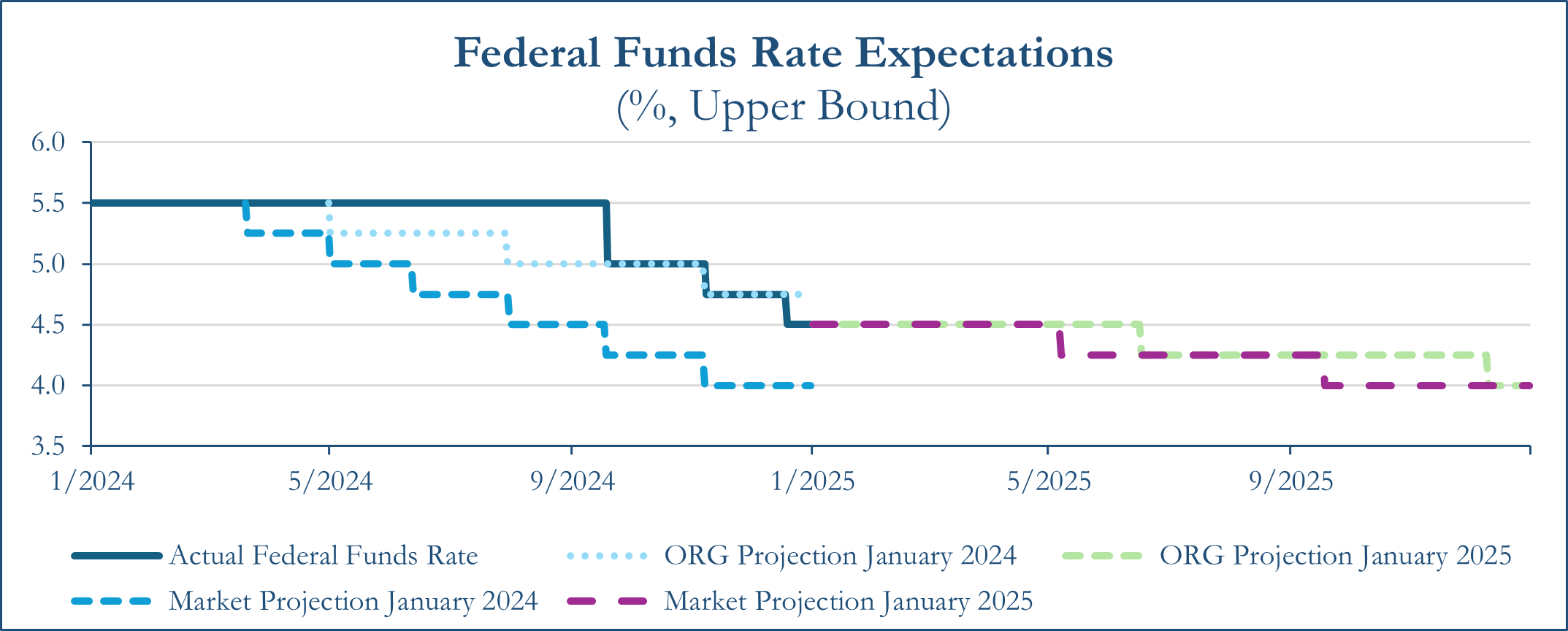

ORG believed it was likely that the Federal Reserve would cut interest rates by 50 to 75 basis points in 2024. The result ended up being 100 basis points of cuts for the year. This course of action by the Federal Reserve to begin the “cutting cycle” more aggressively was justified as falling inflation and rising unemployment made the real interest rate feel too restrictive compared to future inflation and growth expectations. Despite this, the pace of rate cuts could likely moderate if employment data such as the unemployment rate, hiring rate, quits rate and wage increases begin to imply that the employment market shows limited signs of further weakening. For 2025, ORG believes that the Federal Reserve may cut the Federal Funds Rate by up to 50 basis points. Over the longer run, ORG continues to believe that the Federal Funds Rate could settle around 2.5% to 3.0% [1], maintaining a normalized yield curve into the foreseeable future. ORG foresees this being problematic for some real estate equity holders who were anticipating precipitous interest rate cuts at the beginning of the Federal Reserve’s rate cutting cycle.

The Federal Funds Rate decreased less than the market anticipated in January 2024. Sources: Bloomberg, FRED

Strategies and Structures

ORG believes real estate equity will become viable again during the year and that investors should return to the old school “blocking and tackling” strategy of using real estate as a volatility reducing, inflation hedging and income generating asset class. In 2025 ORG will continue to critically think about how real estate can be used to outperform on a risk-adjusted basis. Going forward, ORG believes that the most attractive investments in real estate will be those with day-one income returns that offer a sufficient equity risk premium. This will ensure that new equity deployments have a significant margin of safety and that future rent growth can be seen as additional upside justifying the equity risk. Over the long run, ORG believes that over half of the returns from an institutional real estate portfolio should come from income.

Broadly speaking for equity strategies, ORG believes that manager skill and expertise will be a more important determinant of outperformance or underperformance than property type allocation. Going into 2025, large, scaled allocators who can benefit from big check sizes and low cost of capital as well as small sector specialists who are nimble and have vertically integrated capabilities should be able to outperform. In an environment with interest rates that are higher than the pre-pandemic era, real estate investment managers will need a distinct competitive advantage to generate attractive returns in real estate equity as opposed to expecting returns to come from cap rate compression.

Today, ORG believes that real estate credit funds should be looked at with a more discerning eye than in years past. In 2023 and early 2024, the opportunity in real estate debt became obvious for investors due to the abrupt shock to the real estate capital markets and the need for financing solutions from alternative sources in the absence of bank lending. The opportunity in real estate credit remains attractive as the high income returns from real estate credit funds are stronger than the income returns generated from many core funds in the ODCE index. ORG believes that real estate credit funds with skilled portfolio managers and unique deal flow remain attractive and that credit experience through cycles will be what separates winners from losers. Real estate credit funds will need a unique competitive edge to outperform in the environment of 2025 as the capital markets have been surprisingly resilient, which has led to less demand for real estate credit fund capital. Investors must be aware of the true amount of risk that real estate credit funds are taking. In many cases, they may use repo facilities with capital markets mark-to-market provisions, have high last-dollar loan to value ratios, sacrifice asset quality for returns or reduce the amount of current pay for accrued interest to achieve the 10%-13% net returns that they often market.

Property Types

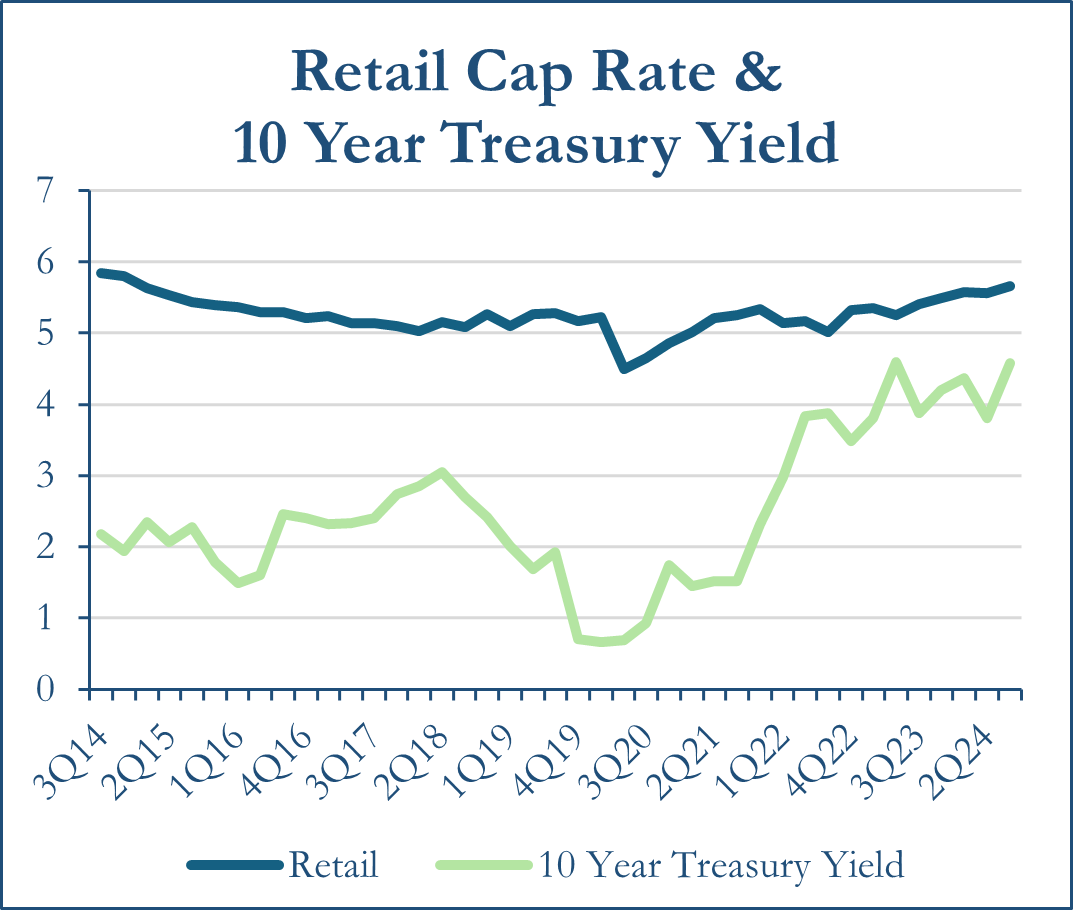

In 2025, retail real estate will continue to be an area of focus as articulated in ORG’s prior article [2]. ORG believes that income generating strategies focused on open-air retail centers will be well positioned to achieve strong returns in the long run. Not only are retail assets priced at cap rates that offer a significant equity risk premium, but they can also target Millennial and Generation Z consumers with growing income and wealth as they continue to enter and develop in the workforce. The property type has also experienced its own transformation through the pandemic that has largely separated obsolete assets from quality assets. The survivorship of open-air retail assets with proper tenant mixes combined with the lack of new supply presents a unique level of downside protection unlike any other property type.

Retail Cap Rates present a 1.08% spread over the 10 Year Treasury as of 3Q 2024. Sources: FRED, NCREIF Property Index

Retail and Office have higher spreads over treasuries than Apartments and Industrial, according to NPI. Sources: FRED, NCREIF Property Index

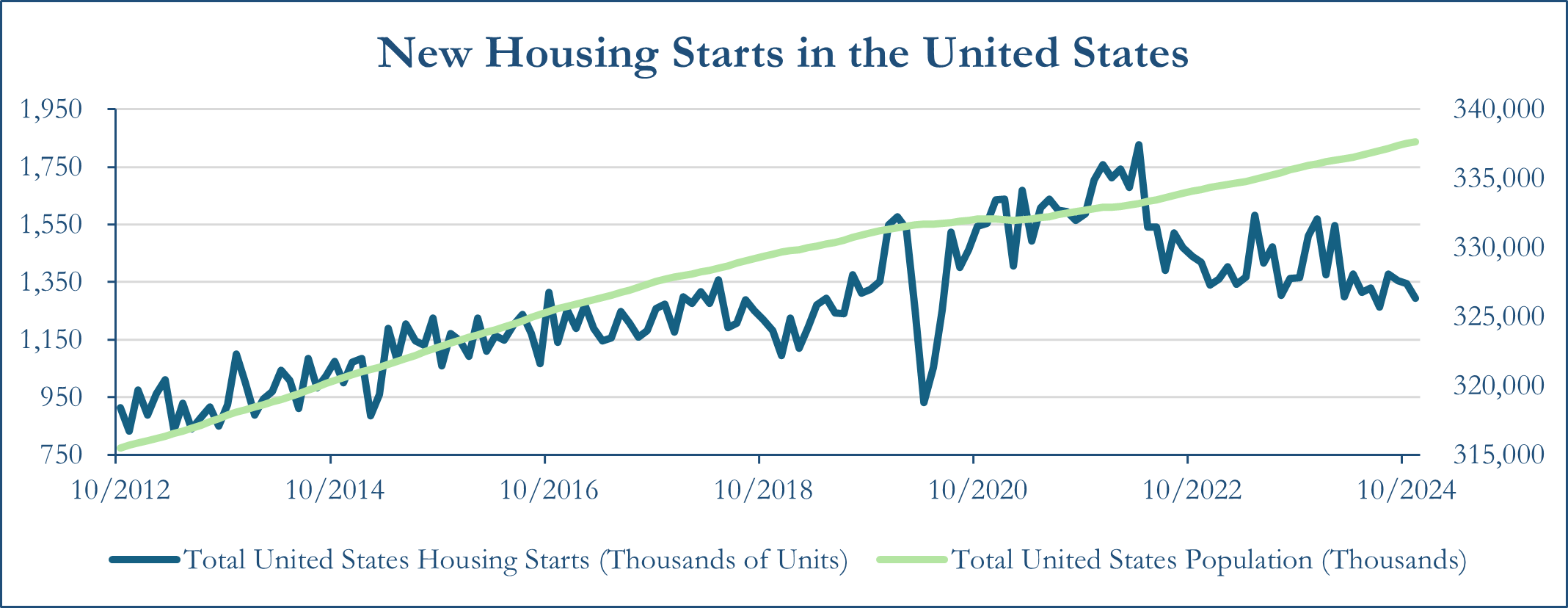

Housing is a sector of interest for the coming year as the structural housing shortage in the United States remains a pressing issue despite oversupply concerns in several markets. Due to the capital market lockup of 2023 and 2024, there is a significant drop off of new supply coming online in 2025 and 2026, which could cause increased rent growth through the latter half of the decade. Day one cap rates and income returns for housing may be low today, however ORG views housing as a promising sector for medium to long term NOI growth. This could present a strong value proposition to generate high long run returns in an institutional real estate portfolio.

A slowdown in new housing starts in 2022 despite continuously growing United States population and household formation has left a shortage of housing supply and impacted housing affordability. Source: FRED

ORG believes that property type allocations may begin to shift away from overallocations to industrial real estate and into other property types. A normalization of industrial leasing fundamentals and low day-one cap rates for core industrial assets could accelerate this trend during the year. ORG also believes that the days of double-digit rent growth through marking expiring leases to market will not last for much longer. ORG believes that positioning industrial strategies to focus on infill assets with fragmented ownership, high going in yields, unique sourcing channels and operational excellence will be necessary to generate attractive long run returns in the sector.

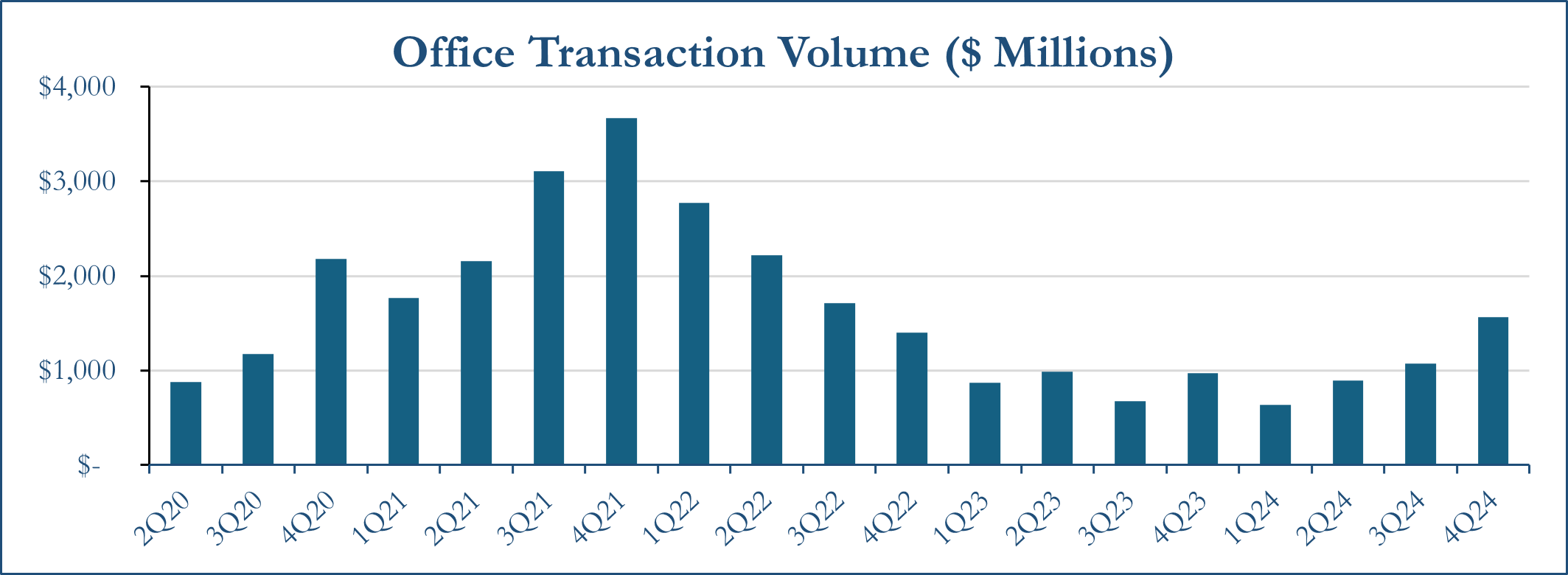

Office remains a sector shrouded in uncertainty of the scale of future demand, however ORG has noticed increasing transaction volume in the property type indicating price discovery and seller capitulation may be a continuing theme throughout 2025. During the year, office owners and lenders are likely to begin to come to terms with their ideas of value, leading to an increase in transaction volume through sales, short sales and foreclosures. This trend may present opportunity for opportunistic buyers. ORG believes new buyer entrants for the sector will be healthy as asking rents can be reset lower based upon discounted purchase prices, attracting new tenants and improving absorption over time. ORG will continue to monitor the transaction market and consider one-off co-investment opportunities that could generate opportunistic returns in a shorter hold period.

Office transaction volumes have begun to increase slightly despite the significant uncertainty in the future of office presented by remote work. Source: CoStar

In the alternative sectors, data centers continue to be an area of interest for many investors. The rent growth from hyperscale tenants remains attractive, however the long run demand for data center space is uncertain as semiconductors continue to become more efficient and the recent development of the Chinese made DeepSeek large language model (“LLM”) calls into question the true amount of capital expenditures required to effectively train LLMs [3]. The fact is that there is limited visibility into the future landscape of these assets because the sector changes and evolves so quickly. As a broad top-down theme, ORG believes that institutional investors should be cautious about investing in data centers. Investors are likely to achieve better risk-adjusted returns from the artificial intelligence theme through the exposure to the technology and energy sectors in their equity portfolios as opposed to pursuing this growth in their real estate portfolios.

Conclusion

The real estate market is poised for a period of opportunity in 2025. While high interest rates remain an important factor to consider, debt and equity capital markets have remained resilient and could continue to become more accommodative to real estate investors throughout the year. ORG believes that a focus on income returns, high entry yields and manager skill and expertise will lead to the most promising returns from the 2025 vintage. Property type allocations may shift with opportunity continuing to grow in sectors such as retail and housing while challenges remain in office.

[1] Stephen Stuckwisch et. al, January 31, 2024 “ORG Portfolio Management – 2024 United States Real Estate Outlook” ORG Portfolio Management News & Insights, https://orgpm.com/ORG%20Portfolio%20Management%20-%202024%20United%20States%20Real%20Estate%20Outlook.pdf

[2] Stephen Stuckwisch et. al, December 17th, 2024 “Retail Real Estate – Understanding the Changing Shopping Preferences of Americans” ORG Portfolio Management News & Insights, https://orgpm.com/Retail%20Real%20Estate%20-%20Understanding%20the%20Changing%20Shopping%20Preferences%20of%20Americans.pdf

[3] James Mackintosh, January 28, 2025 “DeepSeek Undercuts Belief that Chip-Hungry U.S. Players Will Win AI Race” The Wall Street Journal, https://www.wsj.com/tech/ai/deepseek-tech-stocks-a3e83478?mod=wsjhp_columnists_pos_1&mod=WSJ_home_columnists_pos_1